borang e due date

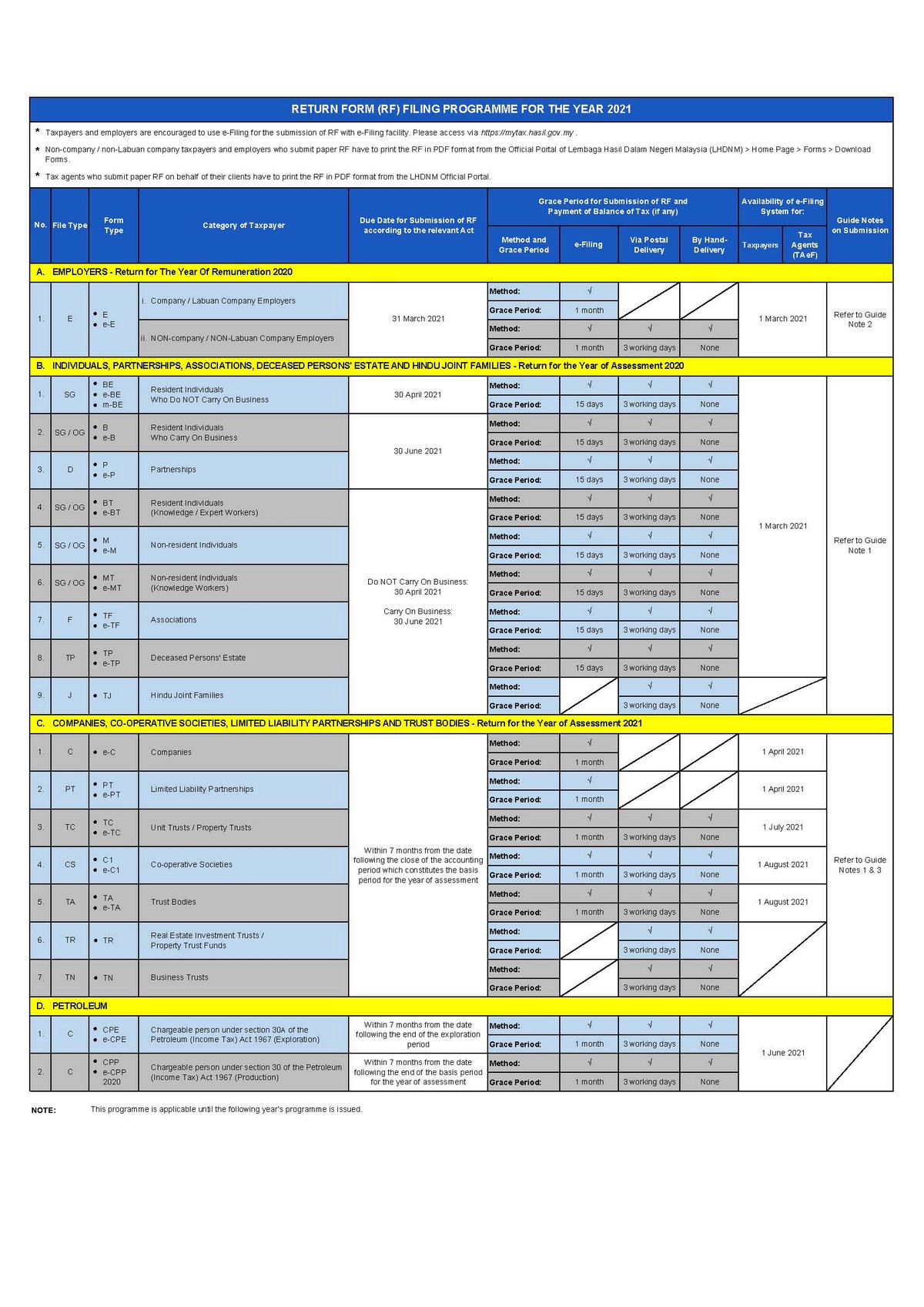

Due date to furnish Form E and CP8D for the Year of Remuneration 2021 is 31 March 2022. All companies must file Borang E regardless of whether they have employees or not.

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Use Form B if carries on business.

. Tarikh akhir pengemukaan Borang BE Tahun Taksiran 2021 adalah 30 April 2022. April 30 for electronic filing ie. Due date to furnish Form E and CP8D for the Year of Remuneration 2021 is 31 March 2022.

30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income. June 3 2022. E 2020 Employer 31 March 2021 BE 2020 Resident Individual Who Does Not Carry On Any Business 30 April 2021 B 2020 Resident Individual Who Carries On Business 30 June 2021 P 2020 Partnership BT 2020 Resident Individual Knowledge Worker Expert Worker 30 April.

Dont be part of this statistic for the new year. Cara Isi borang nyata cukai pendapatan Bila Tarikh buka Tarikh akhir e filing 2021 yang disediakan untuk efiling 2022 lhdn Lembaga Hasil Dalam Negeri sebelum tutup masa deadline. 30 April 2020 submission 15 May 2020 payment.

There are no items to show in this view of the Documents document library. Form E Borang E is required to be submitted by every employer companyenterprisepartnership to LHDN Inland Revenue Board IRB every year not later than 31 March. Due date to furnish this form a 1967 ITA 1967.

Basically it is a tax return form informing the IRB LHDN of the list of employee income information and number of employees it must be submitted by March 31 of each year. Employers which are Sole. Employers who have submitted information via e-Data Praisi need not complete and furnish CP8D.

C IMPORTANT REMINDER 1. 65392 employers were fined andor imprisoned for not submitting Borang E in the Year of Assessment 2014. 7 months after financial year end 8 months for e-filing 8.

7 months after financial year end 8 months for e-filing. Tambahan masa diberikan sehingga 15 Mei 2022 bagi e-Filing Borang BE Borang e-BE tahun taksiran 2021. Tarikh akhir pengemukaan Borang BE Tahun Taksiran 2021 adalah 30 April 2022.

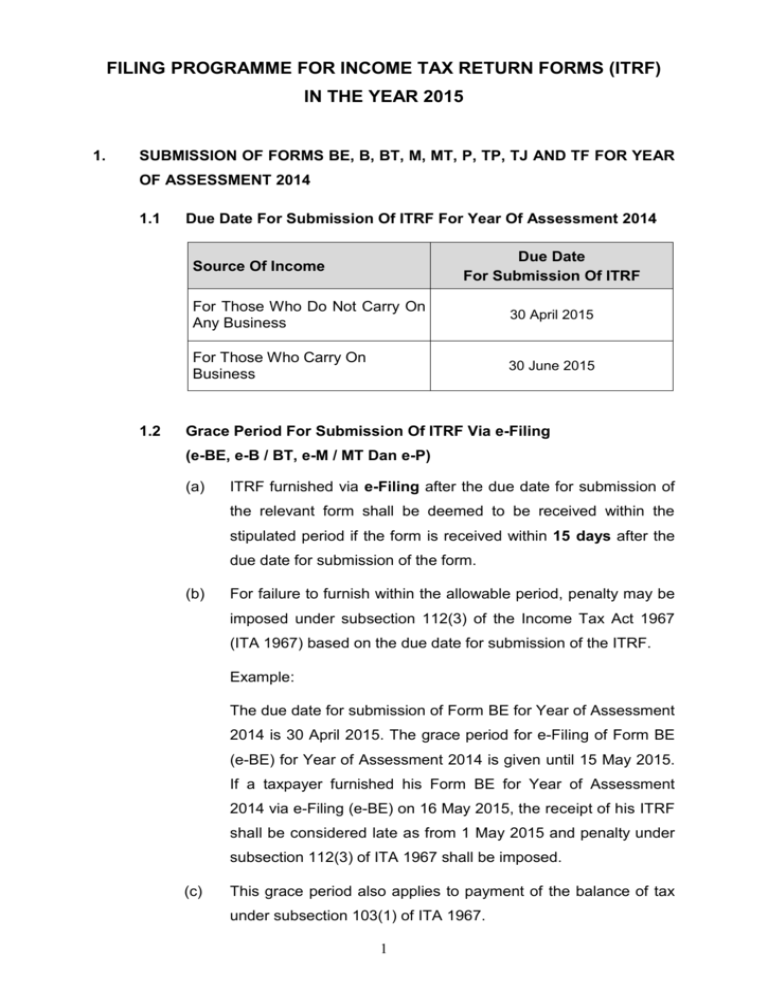

FORM TYPE CATEGORY DUE DATE FOR SUBMISSION E 2019 Employer 31 March 2020 BE 2019 Resident Individual Who Does Not Carry On Any Business 30 April 2020 B 2019 Resident Individual Who Carries On Business 30 June 2020 P 2019 Partnership BT 2019 Resident Individual Knowledge Worker Expert Worker 30 April 2020 does not carry on any business. Payment of tax instalments. FORM TYPE CATEGORY DUE DATE FOR SUBMISSION.

March 31 for manual submission. 1 Due date to furnish this form. Tarikh akhir untuk mengisi dan menyerahkan borang BE untuk cukai individu tahun taksiran 2019 adalah pada 30 April 2020.

The following information are required to. Any dormant or non-performing company must also file LHDN E-Filing. The due date for submission of Form BE for Year of Assessment 2019 is 30 April 2020.

31 March 20 2 Form E will only be considered complete if CP8D is submitted on or before 31 March 2022. Due date to furnish Form E for the Year of Remuneration 2019 is 31 March 2020. SCHEDULE ON SUBMISSION OF RETURN FORMS.

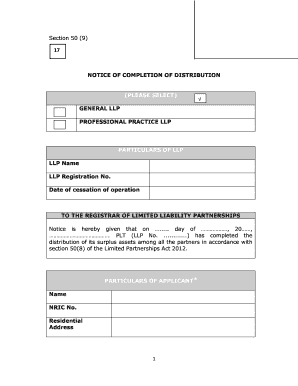

2019 2019 P2D - Pin. Joint assessment Due date for submission both Form BE and B is 30th June. Form PT Income tax return for LLP Deadline.

30062022 15072022 for e-filing 6. Tarikh akhir pengemukaan Borang BE Tahun Taksiran 2021 adalah 30 April 2022. Jika pembayar cukai mengemukakan Borang e-BE Tahun Taksiran 2021 pada 1 Mei 2022 BN tersebut akan dianggap sebagai lewat diterima mulai 1 Mac 2022 dan boleh.

Form C Income tax return for companies Deadline. Paying income tax due accordingly may avoiding you from being charged tax increase court action and. As of 2022 the deadline for filing Borang E in Malaysia is.

Form P Income tax return for partnership Deadline. All companies Sdn Bhd must submit online for 2018 Form E and. Teruskan membaca di sini untuk pendapatan penggajian yang dikenakan income tax malaysia.

3 Failure to pay the tax or balance of tax payable on or before the due date for submission. Form E Borang E is a form that an employer must complete and submit to the Internal Revenue Board of Malaysia IBRM or Lembaga Hasil Dalam Negeri LHDN. Due date to furnish Form E for the Year of Remuneration 2019 is 31 March 2020.

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Swingvy Swingvyofficial Twitter

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Program Memfail Borang Tahun 2009 Dan Isu

Snowflake Gold And Burgundy Rsvp With Meal Options Card Zazzle Com Snowflake Wedding Cards Rsvp

Form 9 Ssm Fill Out And Sign Printable Pdf Template Signnow

2022 Income Tax Return Filing Programme Issued Ey Malaysia

E Filing 2020 Deadline Itr Filing Last Date Income Tax Return Filing Deadline For Fy 2020

What Employers Must Know About Form E Submission 营商攻略

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Max Co Chartered Accountants Posts Facebook

What Employers Must Know About Form E Submission 营商攻略

Blush Pink Gold Geometric Heart Acrylic Mirror Magnet Save The Date Cartalia

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

No comments for "borang e due date"

Post a Comment